by Anne Evans

I find it incredibly irritating as well as downright incorrect when Americans remark to me that surely, I have escaped taxation by having moved to The Cayman Islands.

Hence, this blog is written with the intent to “set the record straight”.

I am not a Tax Attorney. I am not an Immigration Attorney. The information I provide is based on my personal experiences as an expatriate.

Obtaining Residency on Grand Cayman: Residency Certificate Option

My husband and I are US Citizens living full-time in The Cayman Islands. Our last US residence and our current US mailing address is in Florida. Given that we are retired, we are considered by The Cayman Islands to be “persons of independent means” (PIM). The latter provided us with 2 viable options to obtain a Cayman Island Residency Certificate: 1) Residency Certificate for PIM, or 2) Certificate of Permanent Residence for PIM.

We chose to obtain a Residency Certificate for PIM – which is valid for 25 years and renewable thereafter. It entitles us to reside on Grand Cayman in The Cayman Islands without the right to work. This option required the following (CI= Cayman Island dollars):

- A minimum financial investment of CI$1,000,000 (US$1,219,513)

- Of which at least CI$500,000 (US$609,757) must be in developed residential real estate on Grand Cayman

- And either a continuous source of annual income of CI$120,000 (US$146,342) from external sources

- Or a minimum deposit of CI$400,000 (US$487,805) maintained with a locally licensed institution.

There are additional stipulations including criminal, health, and insurance criteria and an Application Fee of CI$500 (US $610).

Once the application is approved, a CI$20,000 (US$24,400) Grant Fee must be paid as well as CI$1,000 (US$1,220) per annum Dependent Fee. This Certificate does not provide a path to British Overseas Territory and Cayman Islands Citizenship nor a British Overseas Territory (Cayman Islands) Passport.

Certificate of Permanent Residence

In contrast, a Certificate of Permanent Residence for PIM is a lifetime grant to reside in The Cayman Islands with the option to apply for a variation to the Certificate to obtain the right to work. This option requires a minimum financial investment of CI$2,000,000, twice the amount of the Residency Certificate (US$2,439,024), which must be in developed residential real estate on one of the three Islands.

There is no specified minimum annual income, although applicants must be able to demonstrate sufficient financial resources to be able to support themselves. There are additional stipulations including criminal, health, and insurance criteria, and the same Application Fee of CI$500 (US$610).

Once the application is approved, the Grant Fee is CI$100,000 (US$121,955), 5 times higher than the Residency Certificate Grant Fee.

The CI$1,000 (US$1,220) per annum Dependent Fee is the same.

This Certificate does provide a path to naturalization as a British Overseas Territory (BOT) Citizen and entitles the Certificate holder to obtain a BOT (Cayman Islands) passport. Once the Certificate holder has been a BOT Citizen by virtue of their relationship with the Cayman Islands for 5 more years, they are eligible to become a Caymanian citizen.

References:

Immigration Transition Act 2022 (pgs. 46-47, cnslibrary.com)

Ogier Cayman Residency Flow Charts

Cayman Islands for residence purposes | Bedell Cristin Legal Services | Bedell Cristin

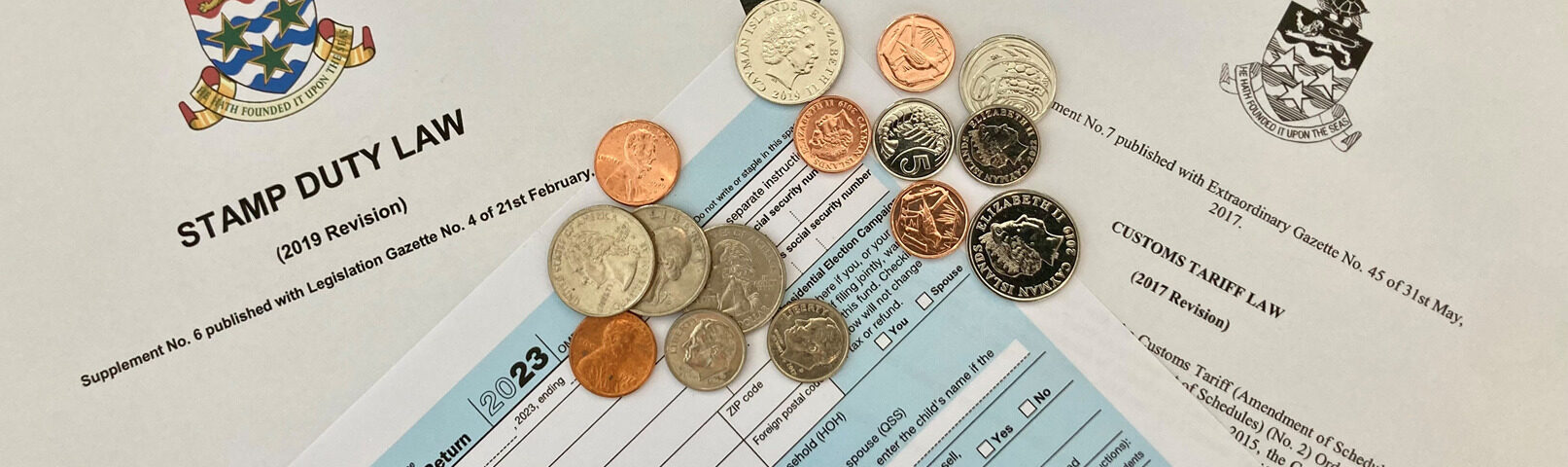

The Cayman Island Taxes

Taxes levied in The Cayman Islands are referred to as “Stamp Duty.” As a US Citizen residing on Grand Cayman, they certainly apply to me. The following are the Cayman Island taxes that I pay as a US Citizen residing on Grand Cayman.

Duty on Real Estate

Perhaps among the most significant aspects of Stamp Duty is its imposition on “conveyance or transfer of immovable property” which is levied at 7.5% of the purchase/sale price of the property (Ref: Cayman Islands Stamp Duty Law 2019 Revision, page 25). This one-time fee is generally assumed by the buyer. In contrast to the US, there is no annual property tax in The Cayman Islands.

Import Duty

Stamp Duty also takes the form of import tariffs levied against the purchase price of nearly any product imported into The Cayman Islands. That includes products imported from the US – including in some circumstances, previously owned property purchased while residing outside of the Cayman Islands. The schedule of import duties can be found in Cayman Islands Customs Tariff Law [2017 Revision], pages 7-229. A substantial number of consumer goods carry import duties at a rate of 22% of the price/value per unit of measure. Be aware, this duty will be in addition to US Sales Tax if you make the initial product purchase in the US. There is no Sales Tax on retail goods in The Cayman Islands.

Duty on Banking Transactions

In accordance with the Cayman Islands Stamp Duty Law and as noted by the Cayman Islands Monitory Authority, banking transactions are also subject to a Stamp Duty of KY$o.25 per item. These include debit transactions for funds withdrawn or payments to third parties. Examples of such items are cash withdrawals, cheques, debit card purchases, ATM withdrawals, wire transfers, drafts, bill payments, etc. The sum of duties is debited from your banking account on a monthly basis.

Additional Reference: Cayman Islands Monetary Authority (cima.ky) – RETAIL BANK FEES AS AT 1 AUGUST 2022

US Taxes

We are US Citizens, and so all taxes relevant to US Citizens residing in the US are just as applicable to us.

Federal Income

We are retired; however a significant amount of our income is taxable, and Uncle Sam is quick to claim his share annually even though (in my opinion) we reap few benefits given how the government chooses to spend our tax dollars.

State Income

Our last US residence and our current US mailing address is in Florida. We have the right to vote in Florida. Florida has no State Income Tax.

Sales

You will pay US Sales Tax on items you purchase for import from the US. Our expenditures on products imported from the US is significant. Sometimes it is because it is the only way we can obtain the product. Sometimes it is because it is still significantly less expensive to import it than to buy it on Island. As an example, consider purchasing a case of shampoo on Amazon Prime. We pay for the product + US Sales Tax. Then after Amazon delivers it to our shipper in Florida, it goes by boat to Grand Cayman where we additionally pay the freight fee + Cayman Islands Import duty of 22%. It adds up.

Conclusion: The Cayman Islands Reputation as a Tax Shelter

I have often heard The Cayman Islands referred to as a Tax Haven. Perhaps I have clarified in this blog that such is not the case for us. The only way I am aware of to “evade” US taxes is to relinquish one’s American Citizenship – an option that I do not have personal experience with.

Is it expensive to live in Paradise? Absolutely. However, it is worth every single Cayman penny for the privilege to do so.

Get The Expatriate Baker’s Free Recipe Book

The secrets of favorite desserts but with a Cayman Islands flair! This 18-page PDF takes you from brownies to shortbread (shared on the Martha Stewart show) to a decadent white chocolate vanilla cognac mousse. Even some savory dishes and breads are included. Request your copy, and we’ll send you a link.

The secrets of some of my favorite desserts but with a Cayman Islands flair! This 18-page PDF takes you from brownies to shortbread (shared on the Martha Stewart show) to a decadent white chocolate vanilla cognac mousse. Even some savory dishes and breads are included. Request your copy, and we'll send you a link.